Grow your money securely with Assurance Fixed Deposit Account. Invest a specific amount of money for a fixed period at an agreed-upon interest rate. At the end of the investment period (tenor), you have the flexibility to either re-invest (roll over) or withdraw (liquidate) your investment along with the interest earned.

Grow your money with the Assurance Fixed Deposit Account, which allows you to invest a specific amount of money for a fixed period of time at an agreed interest rate. At the end of the agreed period (tenor), your investment can either be rolled over (re-invested) or liquidated (returned to you) along with the interest earned.

Manage your account, transfer funds, and access banking services via our secure online platform.

Access your account anytime through our 24-hour call center for inquiries, transfers, and account management.

Visit any of our Assurance branches across Nigeria for personalized banking services.

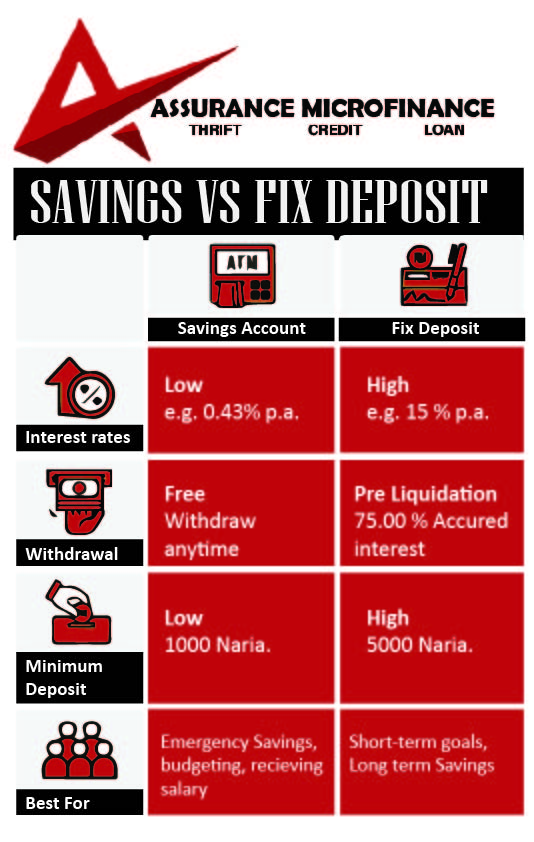

An Emergency Savings fund is a dedicated financial cushion designed to cover unexpected expenses, such as medical emergencies, car repairs, or sudden job loss. It helps protect against financial instability during unforeseen circumstances, offering peace of mind by ensuring you have readily accessible funds when life’s uncertainties arise.

A House Fund is a savings account specifically allocated for home-related expenses. Whether you’re saving for a down payment on a house, home improvements, or routine maintenance, this fund helps you plan for significant purchases or repairs, ensuring you’re prepared for both planned and unplanned housing costs.

Giving and Gift Funds are savings set aside for charitable donations, gifts to loved ones, or special occasions like birthdays, weddings, or holidays. By planning ahead and saving in this fund, you can make meaningful contributions and give gifts without straining your budget, ensuring generosity without financial stress.

| Total variable interest rate | Rate of Interest |

|---|---|

| Interest Rate | N/A % p.a |

| Standard fees (fees may change) | Amount |

|---|---|

| Monthly service fee | ₦100 |

| Online Banking withdrawal | N/A |

| Telephone Banking withdrawal (self service) | ₦0 |

| Telephone Banking withdrawal (staff assisted) | ₦10.00 |

| Branch staff assisted withdrawal | ₦0.00 |

| ATM transactions | N/A |

| Account overdrawn fee | N/A |

| Outward dishonour fee | N/A |

Visit our website to complete the online account application or download the form to submit at any branch.

If you have any questions or need assistance, feel free to reach out to us via:

We are offering loans to buiness, Join us today and Get the support you require to grow you business